The Ohio Homeowner’s Lifeline: How to Avoid Foreclosure

7 Powerful Ways to Stop Ohio Foreclosure (Before It’s Too Late)

If you're a homeowner in Ohio struggling with missed mortgage payments or facing foreclosure, take a deep breath—you’re not without support. Our Ohio Homeowner’s Guide to Foreclosure was created to provide practical, up-to-date solutions tailored to foreclosure laws in Ohio.

Download our FREE guide to learn how to stop foreclosure, protect your credit, and explore real alternatives like loan modification, refinancing, and short sales in Ohio.

WE ARE CASH HOME BUYERS IN OHIO

AS SEEN ON

Get Cash For Your Home Fast, In 3 Easy Steps

No Repairs, No Cleaning up, No Agents, No Commissions, No Hassle, No Stress, Just a Fair Cash Offer and a Closing Date You Choose.

STEP 1

GET IN TOUCH

Once you sign the purchase agreement, we send it along with our earnest money to escrow. Escrow securely handles all funds and documents, protecting both parties. They coordinate the transaction, ensure all steps are followed, and disburse your proceeds once the sale closes.

Timeline: One business day

STEP 2

GET CASH OFFER

At this stage, detailed inspections like sewer line checks are completed. The title company is contacted to verify the seller’s legal right to sell and ensure there are no liens or claims on the property. They protect the transaction from fraud and confirm the title is clear for transfer.

Timeline: 1-2 Weeks normally

STEP 3

WE CLOSE FAST

This final step moves at your pace—quickly or on your timeline. You can sign with escrow in person or have a mobile notary come to you. Once signed and approved, escrow records the sale with the county and releases your funds via bank wire or certified check.

Timeline: This can be done in days or on your schedule

How far behind in property taxes before foreclosure in Ohio

How Long Before Foreclosure Begins?

Delinquent Status (~60 days after missing second payment):

After two missed installments (typically in July/August), taxes become delinquent. If not paid within 60 days of certification, the case may be sent for foreclosure (ohiolegalhelp.org).

Tax Lien Sale (~shortly after certification):

The county may sell your tax lien at auction. The lienholder must then wait at least one year before starting a foreclosure (nolo.com, ohiolegalhelp.org).

Foreclosure Filed (~1+ year later):

After a lien sale, foreclosure can be launched one year from lien purchase. If the lien remains with the county, foreclosure can begin immediately or after that year period (ezsellhomebuyers.com).

Court Process & Sale (~6 months to 1+ year):

Once the complaint is filed, you must respond within 28 days. If unresolved, foreclosure actions including court hearings and sheriff’s sale may take 6 months to over a year, depending on county (ohiolegalhelp.org).

⏳ Summary Timeline

Stage Time from Delinquency Delinquent/Certified ~60 days Tax Lien Sale Shortly after cert. Lienholder Redemption 1 year wait to foreclose Court Filing → Sale 6 months–1+ year

In total, if a tax lien is sold, you generally have around one year before foreclosure begins—and then several more months before a sheriff’s sale occurs. If the county retains the lien, the process can be faster.

🎥 Want a quick breakdown?

How Far Behind In Property Taxes Before Foreclosure In Ohio?

🔧 What You Can Do

Enter a delinquent tax contract with the treasurer to pay in installments—up to 5 years for owner-occupied homes (nolo.com, debtfreeohio.com, codes.ohio.gov).

Redeem your property by paying back taxes, fees, and interest before foreclosure or sale confirmation.

Act fast once the complaint is filed—respond within 28 days to avoid judgment .

Bottom line: You typically have about one year after a tax sale before foreclosure begins—and longer before the property is auctioned off. But it’s best to act early to protect your home.

How to stop foreclosure in Ohio

Stop foreclosure in Ohio, based on state and federal guidelines:

1. Contact Your Lender Immediately

Lenders prefer to avoid foreclosure and often offer options like loan forbearance, repayment plans, or loan modifications. Don’t wait—communicate early and ask for help (clevelandohio.gov).

2. Reinstate Your Mortgage

If your mortgage contract allows it, make a lump-sum payment of all past dues—plus fees—to bring the loan current and halt foreclosure proceedings (nolo.com).

3. Apply for a Repayment or Forbearance Plan

Work with your lender to set up a structured plan to pay back missed payments or temporarily reduce or pause payments based on your circumstances .

4. Consider a Loan Modification

Ask your lender to modify the loan—by lowering the interest rate or extending the term—to make monthly payments more manageable (fhrc.org).

5. Explore a Short Sale or Deed-in-Lieu of Foreclosure

Short Sale: Sell the home for less than owed, with your lender’s approval, to avoid foreclosure on your credit (clevelandohio.gov).

Deed-in-Lieu: Voluntarily transfer the property to the lender to avoid foreclosure, often with fewer consequences than a full foreclosure (investopedia.com).

6. File for Bankruptcy

Filing for Chapter 7 or Chapter 13 bankruptcy initiates an automatic stay, temporarily halting foreclosure. Chapter 13 allows you to catch up on payments over time (nolo.com).

7. Redeem the Property

Ohio law permits homeowners to redeem their property by paying off all overdue amounts before the sheriff’s sale or court confirmation (nolo.com).

8. Seek Free Housing Counseling

HUD‑approved counselors and Ohio nonprofits offer free advice, assist with hardship letters, and help negotiate with lenders (hud.gov).

9. Write a Hardship Letter

Documents explaining your financial difficulties—such as job loss or illness—can support requests for loan modifications or forbearance (investopedia.com).

10. Participate in Mediation Programs

Some Ohio jurisdictions offer foreclosure mediation, facilitating discussions between borrower and lender to find alternatives (investopedia.com).

Aviation Home Buyers can help you avoid a long, expensive court process by offering a fair, all‑cash purchase—even during probate or financial distress. Want to discuss how we can support your specific situation?

NO AGENTS,

NO COMMISSION

Just a fast, fair cash offer for your home. Skip the fees and close on your terms.

NO REPAIRS,

NO CLEANING

We buy houses as is. Let us do all the heavy lifting for you. We make it easy for you.

NO MORE HEADACHES

Bad tenants can be a nightmare. Is your return on your investment even worth it?

NO HIDDEN FEES,

FAIR CASH OFFER

No hidden fees, no surprises — just a straightforward, fair cash offer for your property.

How long does a foreclosure take in Ohio

If you're facing foreclosure in Ohio, you may be wondering how much time you have to act—and how to avoid losing your home.

The Ohio foreclosure process is judicial, meaning it goes through the court system and typically takes 6 to 12 months from your first missed payment to a sheriff’s sale. In some cases, the process can stretch up to 2 years, depending on court delays or legal complications.

Most lenders wait until you're 3 months behind on your mortgage before filing a foreclosure complaint. Once the paperwork is filed, you have 28 days to respond, and if no resolution is reached, the court may approve the sale of your home.

But here's the good news: there are ways to stop foreclosure in Ohio and even sell your house during foreclosure to avoid long-term damage to your credit. At Aviation Home Buyers, we work with homeowners across the state to sell their house fast in Ohio, even if foreclosure has already begun. We offer cash for houses in Ohio, handle the paperwork, and close quickly—often in a matter of days.

If you’re looking for foreclosure help in Ohio or want to know how to avoid foreclosure in Ohio, reach out today. You may be able to sell your house to avoid foreclosure, skip the stress, and walk away with cash in hand. As experienced cash home buyers in Ohio, we make the process simple, fair, and fast.

What Our Clients Are Saying

George Owens

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Kim Wexler

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

James Cart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

⚖️ Know Your Rights Under Ohio Foreclosure Law

In Ohio, the judicial foreclosure process gives homeowners the legal right to respond in court and defend against foreclosure. Our guide outlines these crucial rights, including your right to receive notice of default and a chance to cure it, participate in foreclosure mediation, and access court-sponsored assistance programs. It also explains how to qualify for Ohio’s Save the Dream program and how to use the post-sale redemption period to potentially reclaim your home even after a foreclosure auction.

TRADITIONAL HOME SALE

Pay up to 6% in real estate agent commissions plus additional fees

Offers can be unpredictable and may take months to receive

Expect costly repairs, renovations, and upgrades before selling

Closings are uncertain with no guaranteed timeline

Lengthy sales process, often lasting 6 to 12 months from listing to close

Closing costs can add up to 8-10%, including commissions

Time-consuming cleanup required to remove trash and personal belongings

Sales timeline controlled by the buyer’s schedule, not yours

Pay Zero Fees or Commissions

— You keep more cash in your pocket.

Trusted Buyer

— A reliable real estate solution backed by decades of experience.

Sell As-Is

— No expensive repairs, upgrades, or cleaning required.

No Financing Delays

— We buy with cash, no appraisals or contingencies.

Flexible Closing

— Close in as little as 7 days or choose a date up to 9 months out.

We Cover Closing Costs

— You won’t pay a dime at the table.

Leave the Cleanup to Us

— Unwanted furniture or trash? We’ll take care of it.

You Pick the Closing Date

— Move when you're ready, on your terms.

REAL ESTATE INVESTOR

Unexpected fees can appear at closing

Lack of transparency throughout the process

High-pressure sales tactics that may feel untrustworthy

Often small, local operators without a trusted reputation

Risk of deals falling through, costing you valuable time and money

Closing costs can range from 1% to 3% of the sale price

Time and effort required to clear out trash and personal belongings

Dependent on the investor’s timeline and financing approval

STOP FORECLOSURE IN OHIO

Facing foreclosure in Ohio can be overwhelming, but homeowners have more options and rights than they often realize. Our comprehensive Ohio Foreclosure Help Guide provides a clear, step-by-step overview of the judicial foreclosure process in Ohio, including your right to notice, the opportunity for loss mitigation, and legal protections like the redemption period. With detailed insights into Ohio foreclosure laws, mortgage relief programs, and local market trends, this guide empowers you to make informed decisions—whether you're considering a loan modification, short sale, or selling your home to avoid foreclosure.

In addition to legal guidance, the guide explores current real estate trends in Ohio, highlighting how market conditions can influence your ability to refinance, sell, or negotiate with your lender. It also breaks down options like Chapter 13 bankruptcy, deed in lieu of foreclosure, and foreclosure assistance programs in Ohio, all designed to help you keep your home or exit the process with minimal damage to your credit. Download the free guide today and take the first step toward financial stability and peace of mind.

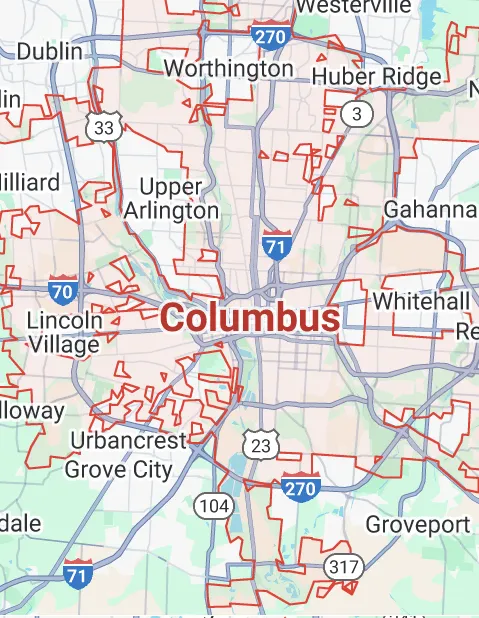

COLUMBUS

Facing foreclosure and need to sell your house fast in Columbus, Ohio? At Aviation Home Buyers, we buy houses for cash—making the process simple, fast, and stress-free. No agents, no fees, and no waiting. Just a fair cash offer and a quick solution to help you avoid foreclosure and take control of your next steps.

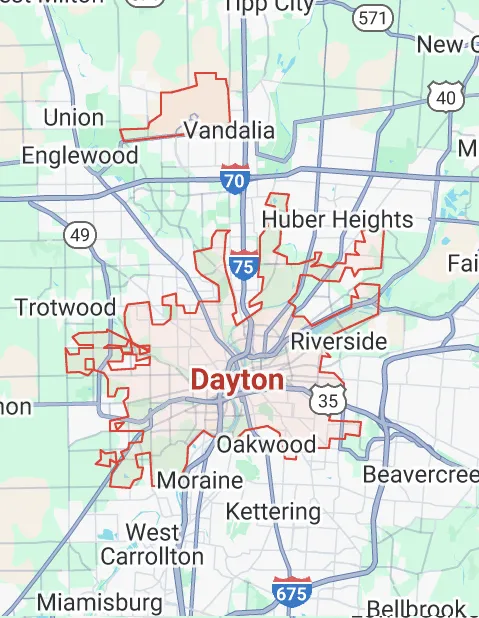

DAYTON

At risk of foreclosure in Dayton, Ohio? Aviation Home Buyers makes it easy to sell your house fast with fair, all-cash offers and quick closings. No repairs, no commissions, and no stress — just a simple way to avoid foreclosure and move on with confidence.

AKRON

Facing foreclosure in Akron, Ohio and need to sell your home fast? Aviation Home Buyers offers fair, all-cash offers for houses in any condition — no agents, no fees, and no hassle. We make it easy to avoid foreclosure and get the cash you need with a fast, stress-free sale.

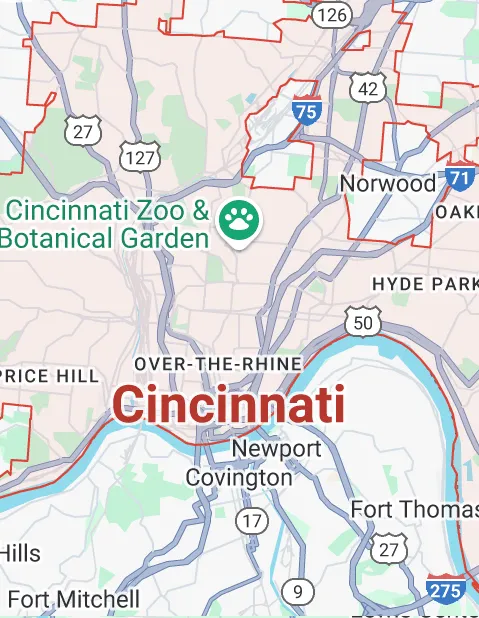

CINCINNATI

Behind on mortgage payments in Cincinnati, Ohio and need to sell fast? Aviation Home Buyers offers quick, all-cash offers for homes in any condition — no repairs, no commissions, and no delays. We help homeowners avoid foreclosure with a fast, stress-free sale so you can move forward with peace of mind.

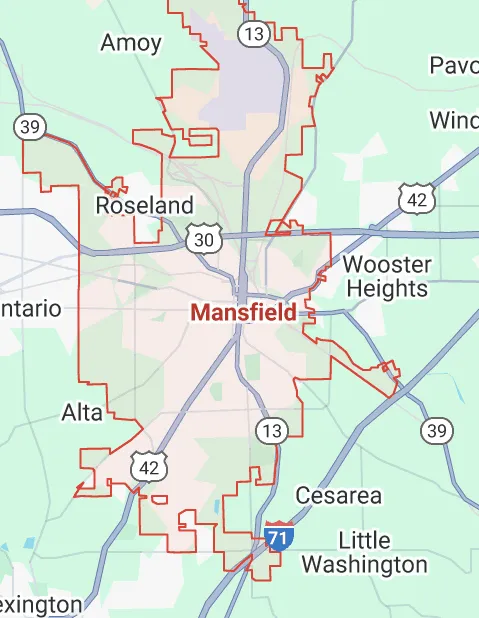

MANSFIELD

Falling behind on mortgage payments in Mansfield, Ohio? Aviation Home Buyers can help you avoid foreclosure with a fast, fair cash offer for your home — no repairs, no cleaning, and no agent fees required. We make it easy to sell your house quickly and move on without the stress of listings or delays.

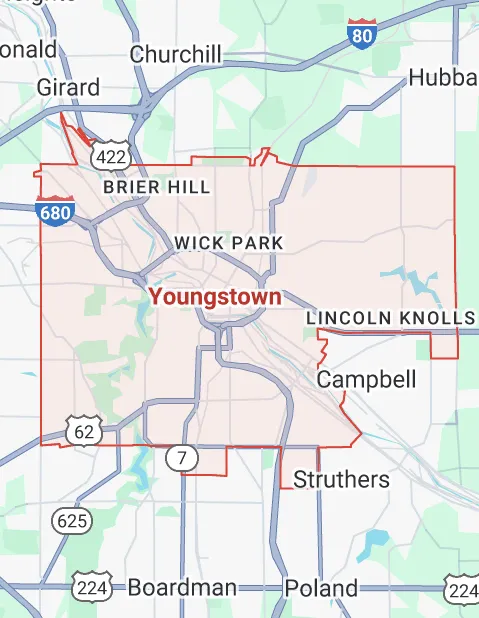

YOUNGSTOWN

At risk of foreclosure in Youngstown, Ohio? Aviation Home Buyers helps homeowners sell fast with fair cash offers and quick, hassle-free closings. No agents, no costly repairs, and no hidden fees — just a simple way to avoid foreclosure and get cash for your house on your terms.

CLEVELAND

Facing foreclosure in Cleveland, Ohio and need to sell fast? We offer quick, all-cash deals for homes in any condition — no commissions, no repairs, and no waiting. Aviation Home Buyers helps you avoid foreclosure and move forward with a simple, stress-free sale on your timeline.

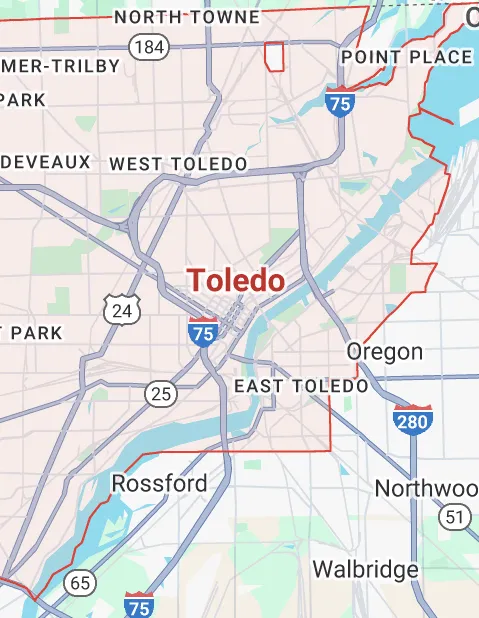

TOLEDO

Worried about foreclosure in Toledo, Ohio? Aviation Home Buyers makes it easy to sell your house fast with fair cash offers, no agent fees, and quick closings — no matter the condition of your home. Avoid the stress of foreclosure and get the relief you need with a simple, no-hassle sale.

Stop Foreclosure Ohio—Explore Real Solutions

Homeowners just like you have used this guide to:

Avoid sheriff sales

Negotiate with mortgage servicers

Understand when to pursue a loan reinstatement

Connect with Ohio foreclosure attorneys and HUD counselors

The right to notice and cure default

Foreclosure mediation options

How to leverage the redemption period after foreclosure auction

Eligibility for Ohio Save the Dream program

How to access Ohio foreclosure court assistance

Chapter 13 bankruptcy for foreclosure defense

Short sales and deed in lieu of foreclosure

Mortgage forbearance plans

Sell Home to Avoid Foreclosure Ohio

If you're facing foreclosure in Ohio and have equity in your home, selling it before the foreclosure process completes can be a smart and financially sound solution. By choosing to sell your home to avoid foreclosure, you can pay off your mortgage, protect your credit score, and potentially walk away with cash in hand. With Ohio's shifting real estate market and rising inventory, acting quickly can help you find a buyer before court proceedings advance—giving you control over the outcome and a chance to move forward on your terms.

Save the Dream Program – Akron, OH

James and Carol, retirees in Akron, were hit with unexpected medical bills and couldn't keep up with their mortgage. Just weeks before foreclosure proceedings began, they learned about Ohio’s Save the Dream program. The state offered temporary mortgage assistance that brought them current, bought them time, and connected them with budgeting support—saving their home and their peace of mind.

Foreclosure Avoided – Toledo, OH

Maria, a nurse in Toledo, contracted COVID-19 and missed two months of work. Her income dropped, and mortgage payments piled up. Acting fast, she contacted her lender and qualified for a mortgage forbearance. The pause gave her time to recover without losing her home, and she later repaid the missed payments through a flexible repayment plan.

Foreclosure Mediation – Columbus, OH

Marcus, a small business owner in Columbus, received a foreclosure summons during a slow season. Instead of giving up, he used Ohio’s foreclosure mediation program. With legal guidance, he challenged fees and delays in mortgage servicing. The mediation process led to a repayment plan he could afford—and he kept his house and business.

Loan Modification – Dayton, OH

Sarah, a single mother in Dayton, lost hours at work and fell three months behind on her mortgage. Afraid of losing the home she raised her son in, she reached out to her lender and applied for a loan modification. With the help of a HUD-approved housing counselor, she negotiated a lower interest rate and extended her loan term—reducing her monthly payment enough to stay in her home.

Selling to Avoid Foreclosure – Cincinnati, OH

Lisa in Cincinnati lost her job and knew foreclosure was inevitable. With equity in her home, she listed it quickly and worked with a local agent who understood pre-foreclosure sales. She sold the home above asking price, paid off her mortgage, and walked away with enough to rent a new place and restart her life.

Chapter 13 Bankruptcy – Youngstown, OH

Tony, a factory worker in Youngstown, fell behind on his mortgage and other debts after a divorce. Facing imminent foreclosure, he filed Chapter 13 bankruptcy. This created an automatic stay and gave him time to reorganize his finances. Over the next few years, he caught up on payments through a court-approved plan—ultimately keeping the home for his two kids.

Avoid Foreclosure in Ohio

Avoiding foreclosure in Ohio starts with early action and understanding your options. Whether you're struggling with missed payments or have already received a notice of default, resources like loan modification, forbearance, refinancing, or state programs like Save the Dream Ohio can help you stay in your home. The key is not to wait—reaching out to your lender, seeking housing counseling, and exploring legal protections can make all the difference in avoiding foreclosure and preserving your financial future.

WE'RE ONE OF THOSE companies that buy houses in ohio

Frequently Asked Questions

Have questions about foreclosure? We’ve got answers. At Aviation Home Buyers, we believe in clear communication and making the process as stress-free as possible. Whether you're unsure how foreclosure works in Ohio, what options you have to avoid it, or how quickly you can sell your home to prevent it — this FAQ section covers everything you need to know about navigating foreclosure and selling your home fast for cash.

What is foreclosure, and how does it work in Ohio?

Answer: Foreclosure is a legal process where a lender repossesses a home after the borrower fails to make mortgage payments. In Ohio, foreclosure is judicial, meaning it goes through the court system. The process starts with a breach letter and ends with a sheriff’s sale if no resolution is reached.

How long does the foreclosure process take in Ohio?

Answer: The foreclosure timeline in Ohio typically takes 6 to 12 months, but it can vary depending on court schedules, responses, and legal actions taken by the homeowner.

What are my rights during the foreclosure process in Ohio?

Answer: You have several rights, including the right to receive notice, the right to respond in court, access to mediation programs, and the right to redeem your property before the court confirms the sale.

Can I stop foreclosure once it starts?

Answer: Yes. Options like loan modification, repayment plans, forbearance, refinancing, or even bankruptcy can help stop or delay foreclosure. Contacting your lender early improves your chances of success.

What is a judicial foreclosure?

Answer: A judicial foreclosure involves filing a lawsuit in court. In Ohio, the lender must prove that the borrower defaulted before the court can approve the foreclosure and order a sheriff’s sale.

What is the redemption period in Ohio foreclosure?

Answer: In Ohio, you generally have until the court confirms the sale to redeem your home by paying the full amount owed. This gives you one last chance to save your property even after the auction.

Can I sell my home to avoid foreclosure in Ohio?

Answer: Yes. If you have equity, selling your home before the foreclosure sale can pay off your mortgage, protect your credit, and help you avoid court proceedings. This is often a better alternative than foreclosure.

What is the Save the Dream Ohio program?

Answer: Save the Dream Ohio is a state-run program offering financial assistance, counseling, and foreclosure prevention resources to struggling homeowners. It’s designed to help you stay in your home or exit foreclosure gracefully.

Will foreclosure ruin my credit?

Answer: Yes, foreclosure can significantly damage your credit score and remain on your credit report for up to 7 years. Avoiding foreclosure through other means—like a short sale or loan modification—can reduce the impact.

Where can I get help if I’m facing foreclosure in Ohio?

Answer: Start by contacting a HUD-approved housing counselor or legal aid service in your area. You can also reach out to the Ohio Attorney General’s Save the Dream program or a foreclosure defense attorney for personalized guidance.

We buy foreclosure houses for cash, Ohio

Facing foreclosure? We buy houses fast for cash in Ohio — no matter your situation. If you're behind on payments or need to sell quickly to avoid foreclosure, Aviation Home Buyers is here to help. We buy houses in any condition with no agents, no repairs, and no delays. Get a fair, no-obligation cash offer today and see why we’re one of the most trusted cash home buyers in Ohio for homeowners looking to stop foreclosure and move forward with peace of mind.

COMPANY

CUSTOMER CARE

LEGAL

FOLLOW US

Copyright 2026. Aviation Home Buyers. All Rights Reserved.